JSW’s Materials & Engineering Business Segment secured orders for electric-power and nuclear-related products, as well as defense equipment, at levels exceeding expectations, resulting in higher revenue and operating profit year-on-year. With demand in the electric-power and nuclear sectors growing significantly and the market showing a clear recovery trend, the company has revised upward its order and profit outlook for the end of FY2026.

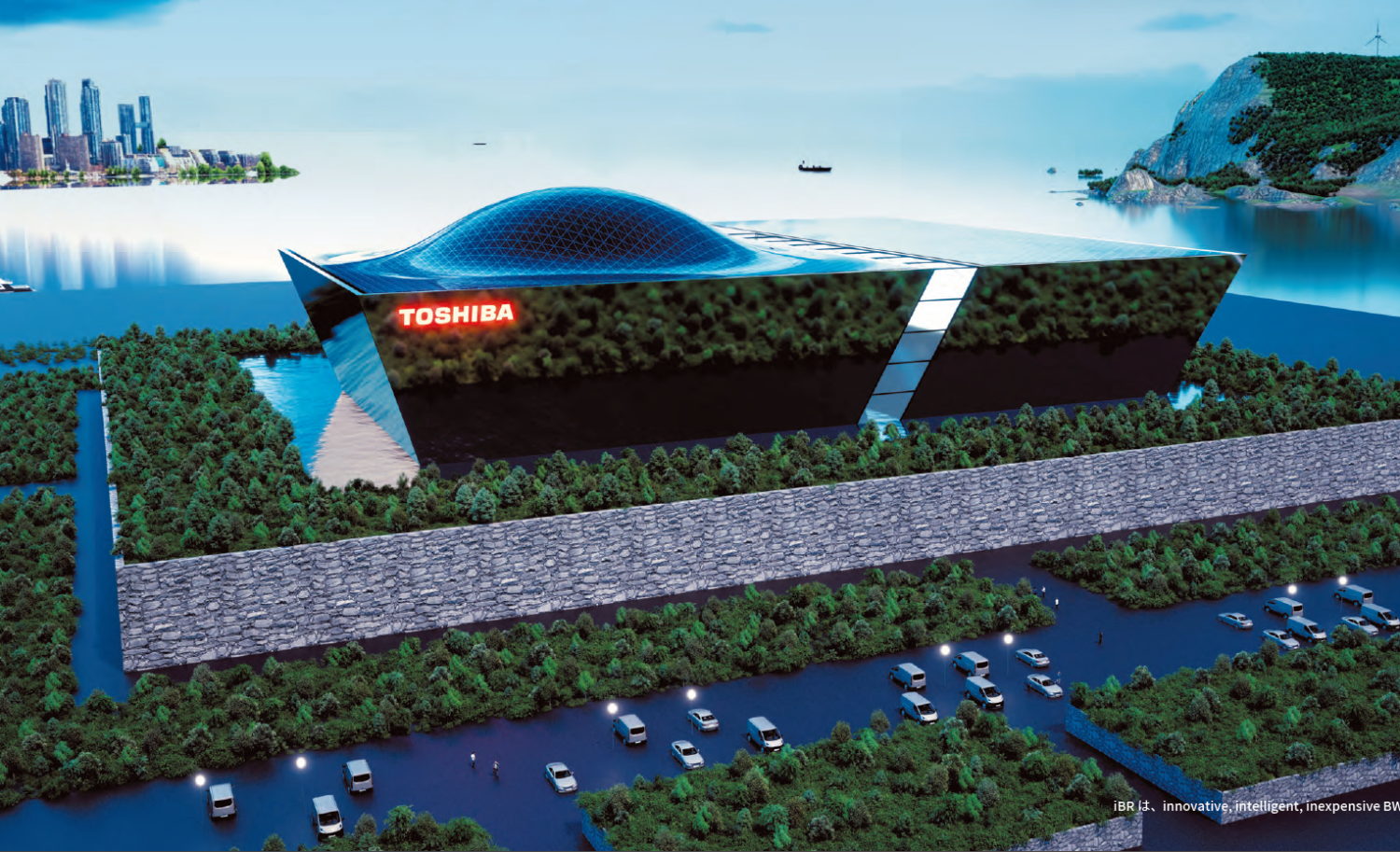

President Matsuo stated, “Especially in Europe and North America, new nuclear power plant construction and lifetime extensions are progressing. France plans to build six EPR2 units, and SMR construction projects are moving forward in Canada. In the United States, lifetime extensions of existing reactors and new SMR projects are gaining momentum. We see these as promising markets for the future.”

When asked by a reporter about references in the briefing materials to AP1000 and SMRs, Matsuo responded, “We received SMR orders last fiscal year. As for the AP1000, once construction is confirmed and equipment manufacturers are finalized, it will represent a major business opportunity for us.”

He also noted that, in Japan, policies to maximize the use of nuclear energy are advancing lifetime-extension work on existing reactors and development of next-generation advanced reactors. “Demand for cask components used for the transport and storage of spent fuel is particularly strong,” he said, adding, “We intend to move quickly to build a system capable of meeting long-term growth in demand.”

The new investment will include upgrading and enlarging ESR (Electro-Slag Remelting) equipment required for manufacturing large components used in nuclear and high-efficiency fossil-fueled power plants. JSW will also install additional manipulators to improve efficiency in forging processes. Furthermore, anticipating continued high demand for large rotor shafts, the company will introduce an ultra-large lathe to expand production capacity.