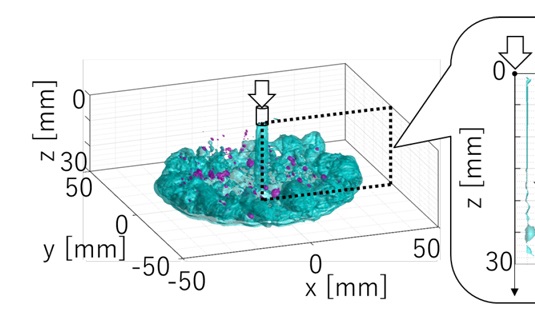

Clearance metal refers to metal waste generated during the dismantling of nuclear power plants and other facilities that has been confirmed by the government to contain extremely low levels of radioactivity, such that any impact on human health is negligible. Materials that meet prescribed standards and receive national authorization may be reused or disposed of in the same manner as ordinary metal.

In this case, reinforcing bars processed from clearance metal (“clearance rebar”) were adopted at two bridge construction sites underway in Tsuruga City and Minamiechizen Town. In Tsuruga City, substructure reinforcement work is progressing on Matsubara Bridge, where approximately 23 tons of clearance rebar are being used for one of the bridge’s two piers. Meanwhile, in Minamiechizen Town, substructure work for the (provisional name) Sabanami Bridge is underway, with approximately 31 tons of clearance rebar used for two of the bridge’s four piers.

Fukui Prefecture has already undertaken active efforts to promote understanding of the clearance system. Products utilizing clearance metal have previously been installed as benches on the campus of the University of Fukui, bicycle racks along the Wakasa Cycling Route, and security lights at Fukui Minami High School. According to the Agency for Natural Resources and Energy, as of August 2025, approximately 6,800 clearance items have been reused across 26 prefectures nationwide.

At the same time, consumption of clearance metal has remained limited and has tended to be confined primarily to casting applications. In light of this situation, Fukui Prefecture has been working in cooperation with the national government and electric utilities to promote broader understanding of the system. Looking ahead, the prefecture aims not only to expand processing and utilization in large-scale construction materials markets, but also to realize “free release,” enabling clearance materials to be widely used in general society without restriction to specific applications.

-013.jpg)

-049.jpg)

.jpg)